Jacquelyn Cooley, market research analyst, 1010data

On the surface, Costco and Sam’s Club appear to have similar business models: Charge membership fees that gives consumers access to low-priced bulk items from their warehouses. Online, however, their strategies couldn’t be more different.

As the battle for ecommerce market share intensifies, Sam’s Club, the warehouse club subsidiary of Walmart Inc., has poured money into infrastructure and technology to service consumers’ ever-growing desire to have a quicker and more convenient online shopping experience. On the other hand, Costco continues to focus on driving the consumer to their physical stores, expecting ecommerce sales to materialize naturally over time. This approach has yielded a relatively unsophisticated website for Costco, placing limits on what a consumer can order online and pick up in store.

Walmart is No. 3 in the Digital Commerce 360 (formerly Internet Retailer) 2019 Top 1000 ranking of North America’s leading online retailers. Costco Wholesale Corp. is No. 15.

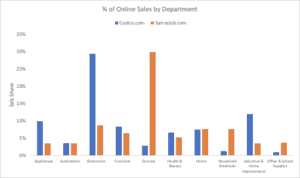

Costco and Sam’s Club’s differences in digital strategy have created a division between the two in terms of what categories sell best through their online platforms.

Costco shines by selling large items online that otherwise would take up significant shelf space in stores. Over 50% of dollars spent in the last year on Costco.com were in the Appliances, Electronics or Industrial & Home Improvement departments. These three departments only comprise 15% of Samsclub.com sales.

On the other hand, Sam’s Club’s robust pick-up-in-store and home-delivery services allow the retailer to excel in fast-moving consumer goods. 38% of sales come from Grocery and Household Essentials, which grew at 22% and 48%, respectively, on Samsclub.com.

Sam’s Club Takes the Cake

Supermarkets and online pure-play merchants alike are vying for their piece of the $15.4 billion online grocery pie—a “pie” that is growing by a whopping 32% year-over-year. Costco holds just 1.2% of grocery sales share, declining 3.1 share points in the last year. By contrast, Sam’s Club holds 5.1% share, declining just 0.4 share points.

These declines have largely been driven by the tremendous success Walmart and Instacart are seeing in online grocery sales as they expand their geographic availability. Nonetheless, Sam’s Club has certainly established itself as the go-to retailer for bulk groceries online.

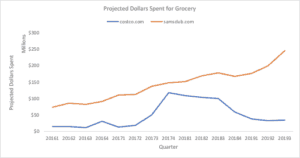

While Costco has taken a back seat in online grocery innovation, it once more closely competed with Sam’s Club. Between Quarter 4 2017, and Quarter 3 2018, Costco gained traction through increased assortment, particularly in the beverage and tobacco categories.

However, a change in strategy resulted in expensive-to-ship products, like beverages and nearly all perishable items, to shift over to Instacart. Costco members can use Instacart to receive same-day delivery for groceries, although most of the dollars spent on Costco.com did not immediately move over to Instacart.

While grocery sales continue to decline through Costco.com, Samsclub.com has seen sustained growth, and in the most recent quarter, saw seven times more dollars spent for grocery items than Costco.com saw. Quite literally, Sam’s Club has sold three times more cake online than Costco has.

If Costco decides one day that it wants to compete with its direct competitor Sam’s Club (and ultimately, Sam’s Club’s parent company, Walmart) in one of the fastest-growing categories online, Costco will need to approach online grocery differently. Perhaps the largest, most costly, change would be adding a buy online, pick up in store service that has driven Sam’s Club’s success in the space.

1010data provides data analytics and business intelligence technology.

Favorite