One of the few positives to come out of the pandemic is the proliferation of ecommerce. According to Digital Commerce 360/Bizrate Insights’s April coronavirus survey of 1,000 online shoppers, the following findings were noteworthy:

- 55% of online shoppers had placed at least a few more orders

- More than 69% of online shoppers rated online retailer performance an 8 or higher

- 58% of online shoppers expected to order more online in the next few months

One can only assume that a significant number of shoppers were pushed into trying ecommerce for the first time while others were forced to buy more online due to physical store closures. Now that the comfort levels among these shoppers has risen, they too are potential candidates for even more shopping online. We can certainly thank grocery stores, Amazon, Target and Walmart for facilitating these experiences, especially during the height of the coronavirus.

Average ecommerce is no longer an option

Brands and retailers who had underinvested in ecommerce learned a tough lesson: that ecommerce is no longer optional. Shoppers have become even more discerning, understanding what constitutes a strong site vs. one that is seen as more mediocre. They had plenty of time during the pandemic to ascertain which retailers got it right and which became marginal.

Little has changed regarding consumer expectations; nonetheless, shoppers are going to make choices about where they take their chances. It’s one thing if a consumer has a relationship, but it’s another if it’s a first time visit with a retailer.

I found myself on a number of the sites that were unprepared and was surprised to see such challenges given ecommerce’s longevity, established standards and heightened expectations. Let’s take a look at what frustrations online shoppers experienced when we asked late last year. For this, I harken back to some of our research on the customer experience conducted by Digital Commerce 360/Bizrate Insights.

Let’s focus on the top 5. The first two start with product page details. I’m still encountering sites that fail to provide enough images and others find sites with only limited descriptions. Both often result in abandonment as shoppers like me lack the information to make educated buying decisions.

Personally, my biggest issue really stems from search that returns irrelevant results. Like most other shoppers, I don’t have the patience to wade through poor search results. The notion of being unsure of shipping costs is also critical and ranked No. 3 on the list of frustrations encountered, where 42% of survey respondents were unsure of shipping costs prior to checking out. We know from our March free shipping survey of 1,000 online shoppers that 70% of non-Amazon orders included free shipping. One can only conclude that shoppers are on the hunt for their favorite promotion, where a lack of pricing transparency is problematic. Lastly, the inability to check product availability at a retailer’s local store was noted pre-pandemic by 29% of respondents and certainly is a greater challenge today.

Inventory and an in-stock position elevate in importance

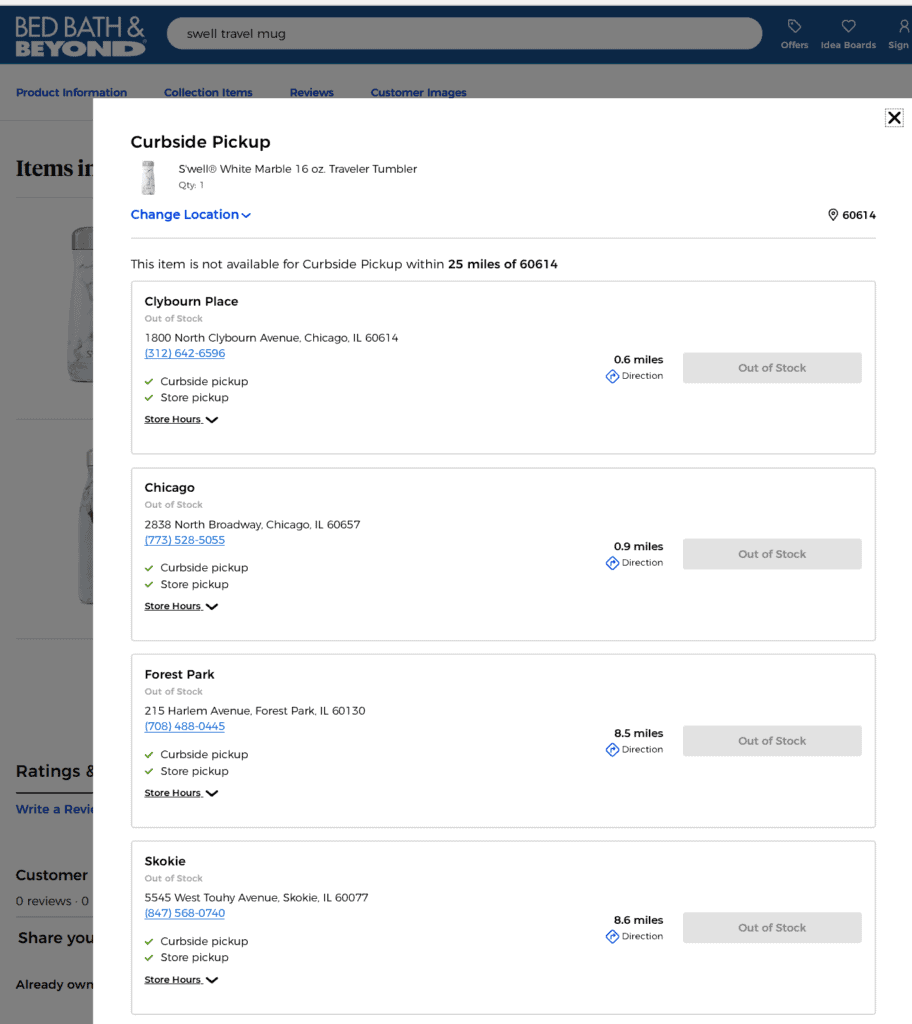

If a product is not in stock, a retailer is immediately off the list—Father’s Day proved to be a perfect example of this. I was on the hunt for a Swell travel mug for my dad, something that had been heavily promoted. Armed with a Bed Bath and Beyond 20%-off coupon and a recently opened store location nearby, I thought I would start there. Unfortunately, the “out of stock” messaging was prominent. I can appreciate one store nearby being out of stock, but four without stock is not acceptable—unless it’s Clorox wipes. This poor inventory position then becomes etched in my mind and these retailers are unlikely to be go-to candidates for me in the future.

Instead, I headed to Target and added on several additional household items I knew I could use. Thus, the fate of a store without stock is once again sealed. Those retailers that invest in inventory and systems are simply better positioned to survive.

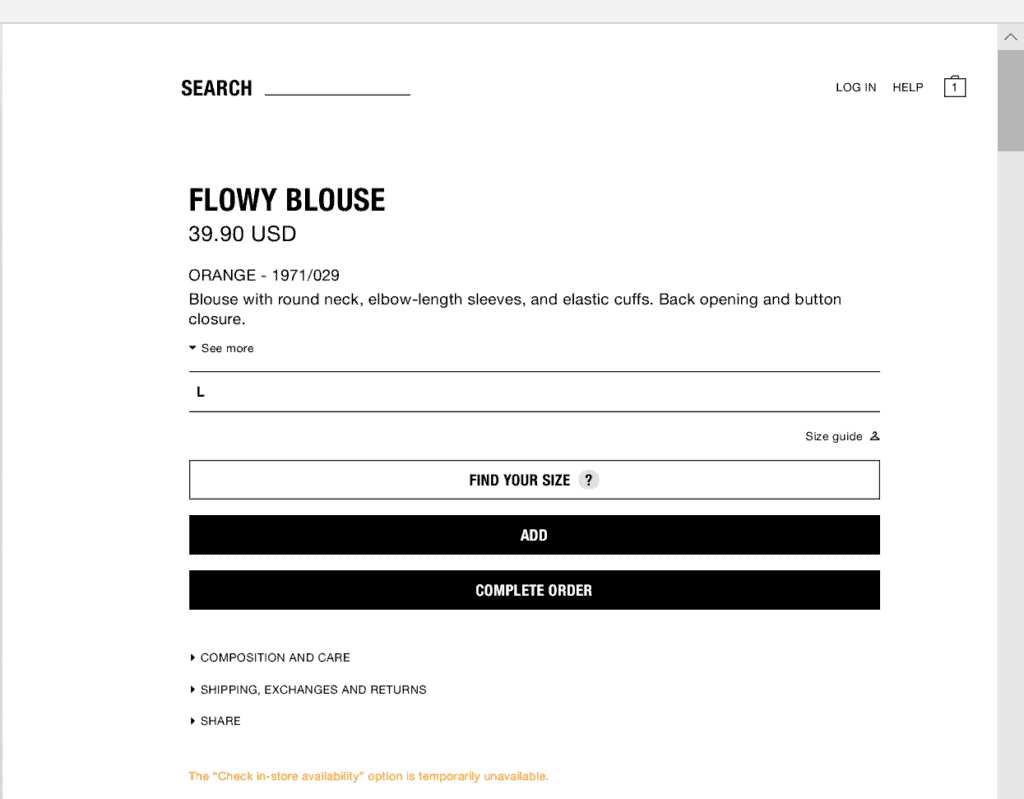

Omnichannel is a given, post-pandemic, and that too starts with inventory. This is where Zara misses out as no visit to a store is complete without the confidence of knowing the inventory that is available. Their fine-print messaging that inventory lookup is not available falls short for the mainstream shopper.

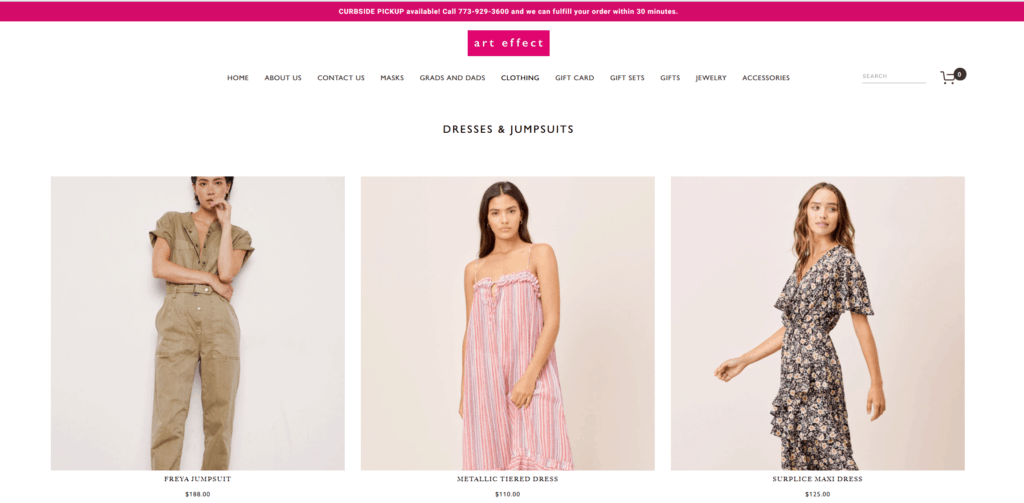

Additionally, when small retailers like Chicago-based Art Effect know that curbside pickup must be part of the package to survive, larger retailers are likely to continue to address this need as well.

Retail executives have also spoken out about how these initial curbside efforts may continue given the customer adoption seen during COVID-19. Retailers like Best Buy, Petco and Michael’s realized that necessity was the mother of invention with omnichannel once again propelling their business during the perilous first few months of the coronavirus.

The store’s role as a strategic advantage for immediacy has been removed

Retailers have come to realize the heightened role of same-day delivery and next-day options. As the hours of some stores are temporarily cut back, they may no longer be in as favorable a position to solve the immediacy issue. I took a look at Ace Hardware knowing how competitive the market is for barbecues. I found it interesting that they had delivery and assembly as part of their offer. I might consider them but closing at 5 p.m. would be restrictive for many working people. Taking a look at Home Depot, they are open until 10 p.m., so I’m more inclined to go there or, better yet, sign up for the fast delivery of my choosing.

No one knows how long this will last

As states move in and out of phased re-openings and coronavirus cases continue to rise, there is much uncertainty and retail stores will undoubtedly be impacted. Apple is just one example of a retailer who opened some stores only to close them not long after in four states based on the pandemic. This type of uncertainty fuels shoppers going online.

My daughter is in the market for a new computer and wants to trade in at Apple. With the stores opening date uncertain, we may look elsewhere as being open may be most important at this point in time. Abt became a perfect solution as their competitive prices and best-in-class services better fit our needs. Like many others, 38% of online shoppers in Digital Commerce 360/Bizrate Insights April coronavirus survey indicated they wanted to shop local to support stores and we concur.

You only want to spend a limited time in the store

I was out and about last weekend and found that, while I was happy to be in stores, I wasn’t looking to spend significant time there. I also felt like I would prefer to try on clothes at home and return to the store should the sizing or styles I selected not be up to par. My concern is whether shoppers begin to abandon those store visits and simply opt to shop from home. For me, the return without the store was the biggest hassle and that is no longer an issue, so I’m still inclined to increase these in-person visits.

We want to go to the store. We want to visit and see what’s new. But we implore retailers to allow us to check inventory and provide normal business hours. And if necessary, omnichannel solutions such as curbside pickup to ensure satisfaction and customer-centric shopping solutions must be in place. We hope to visit soon.

Favorite