2022 web sales for Digital Commerce 360’s Top 1000 retailers in the U.S. health and beauty industry reached just over $29 billion.

The beauty category has ever-changing selling models with both Sephora and Ulta partnering with retailers (Kohl’s and Target, respectively). At the same time, brands often go direct to the consumer with physical stores or online, and can be absorbed into larger brand entities.

The products have evolved, the merchandising is more sophisticated and that leads to better decision making on the part of the customer. The community plays an important role when it comes to engaging the customer as social tools introduce the consumer perspective from in real life moments to influencers.

Beauty retailers detail what we stand for

Just like there are foundational products, there are fundamental merchandising techniques to expect in the health and beauty category. It’s instructive to begin with brand. Shoppers have taken a stand and increasingly they want to know what the brands they buy from represent. As part of the site experience, BH Cosmetics gives shoppers a quick snapshot covering everything from diversity and inclusion to sustainability.

BH Cosmetics shares what it stands for on its homepage.

Efficiencies assist time-starved shoppers

Replenishment is core to the beauty business, and retailers and shoppers alike look for tools that deliver that efficiency. In a Digital Commerce 360 and Bizrate Insights of 718 online beauty buyers in August 2020, 40% said most of their beauty purchases online are replenishment-focused.

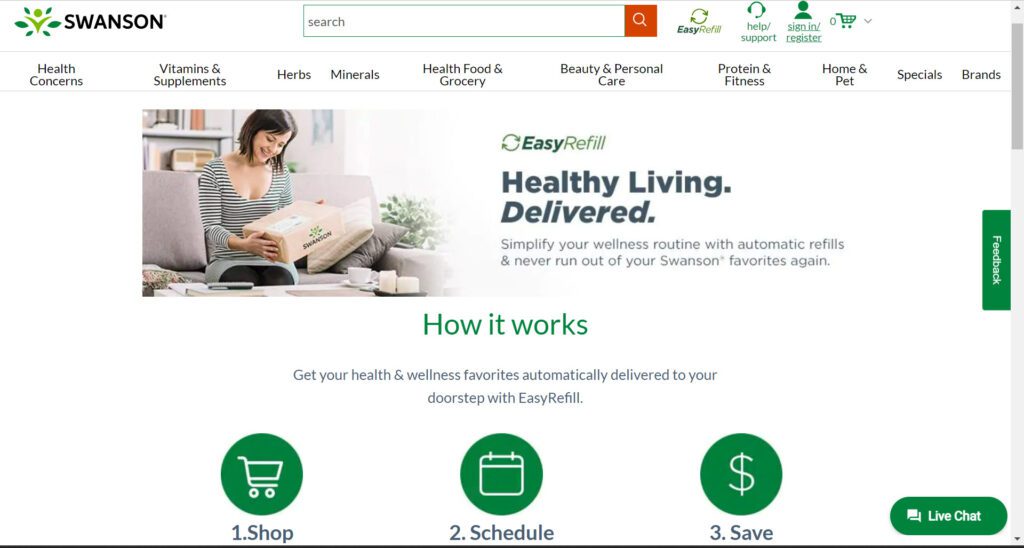

Swanson has put in place an easy refill tool so shoppers can efficiently order their favorite vitamins and supplements. The retailer’s “how it works” approach is helpful for shoppers and reinforces savings.

Swanson details its EasyRefill program.

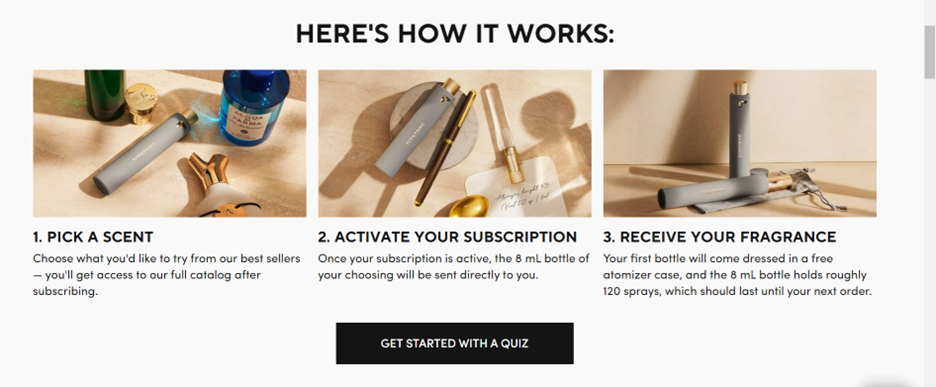

Another efficiency that has proven to be important is the subscription model, which is also intrinsic to this category and featured on Scentbird. 20% of shoppers in the above-mentioned beauty survey find subscription services influential to their selection of beauty products online. This is powerful.

Scentbird shares how its subscription model works.

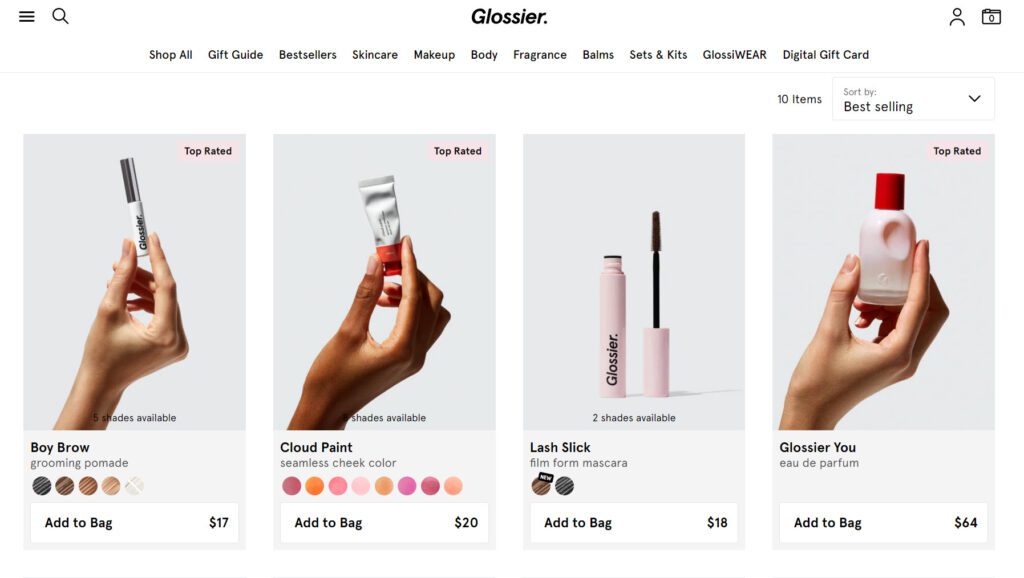

Beyond some of the efficiencies is calling out products that are new and top rated. Glossier is just one example of a brand that keeps those products front and center via merchandising.

Glossier merchandises top rated and new products.

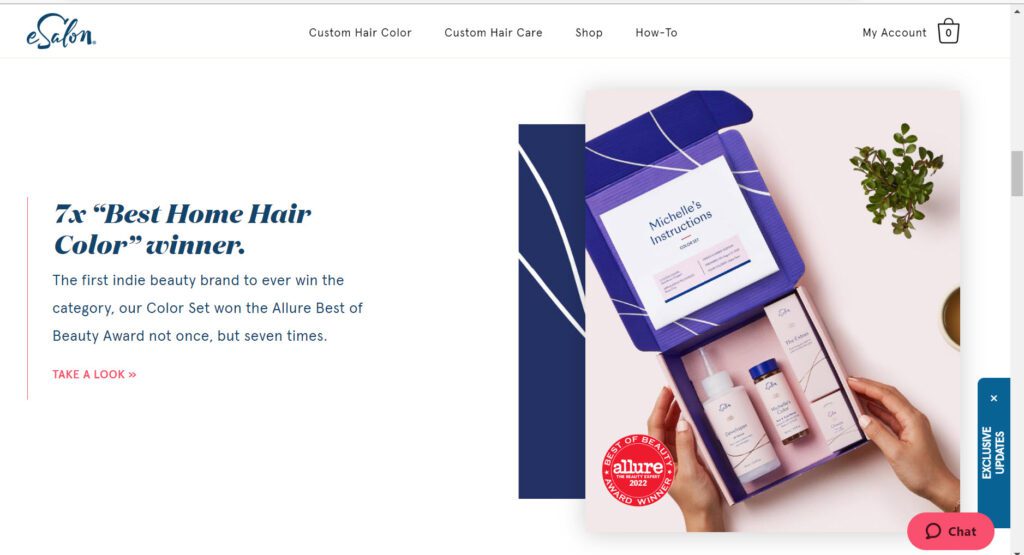

Awards, mostly emanating from print media, propel both products and businesses. Beauty magazine Allure cited eSalon seven times as the best home hair color winner and the brand positions this award prominently on its website.

eSalon touts Allure’s Best of Beauty award.

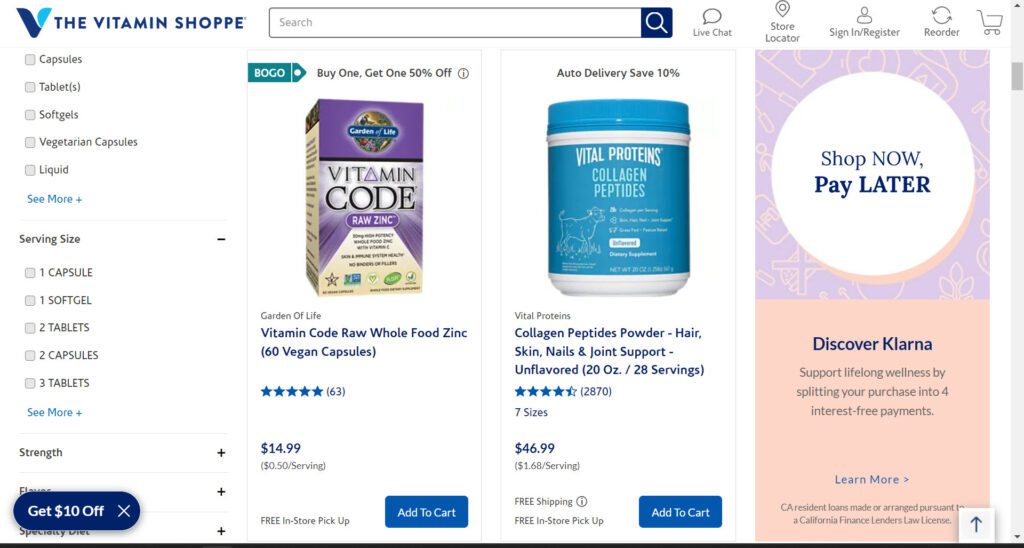

Lastly, more retailers are integrating financing options. The Vitamin Shoppe features messaging in its search results for Klarna’s shop now, pay later. When asked about the top five most important factors in selecting a retailer for the holidays, 11% included this capability. Though lesser in importance than others, many shoppers have nonetheless come to rely on such financing options.

The Vitamin Shoppe offers its customers financing options.

Information ignites shopper decision-making

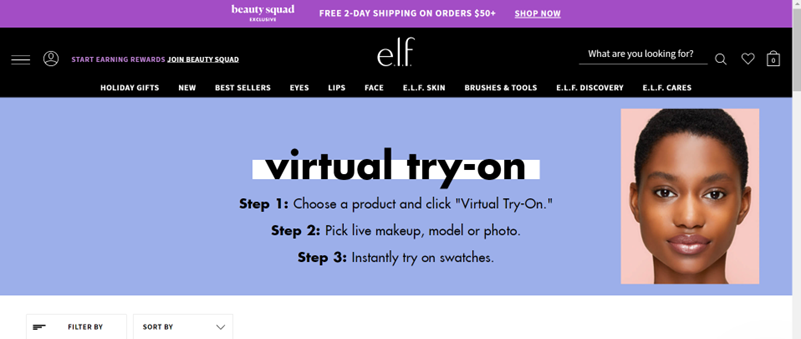

This is a category like many where information is valuable. In October 2022, Digital Commerce 360 and Bizrate Insights conducted a web design survey of 1,107 online shoppers. The survey looked at well-designed and functional online shopper experiences. Videos (21%), how-to guides (17%), the ability to profile one’s shopping needs (13%) as well as virtual try-on tools (11%) show varying importance from a design and functionality point-of-view. Despite their lower penetration numbers relative to other features, they remain important to a truly robust and engaging shopping experience, particularly in the beauty category.

Quizzes are particularly valuable in the health and beauty arena. LiquidI.V. wants to help and seeks information about your lifestyle. The retailer starts with age and moves right into your wellness routine (from nonexistent to carefully curated). Of course, it wants to know what’s important, and that includes everything from staying hydrated to digestive support. It covers beverage intake, including when you crave caffeine. The retailer rounds it out with your flavor preference to make a personalized suggestion.

LiquidI.V. profiles customers to find their Multiplier Must-Haves.

These initiatives also were reinforced in our beauty survey, where 26% cited the ability to profile beauty needs. 18% cited how-to guides or video tutorials, and 8% noted virtual try-on tools as important.

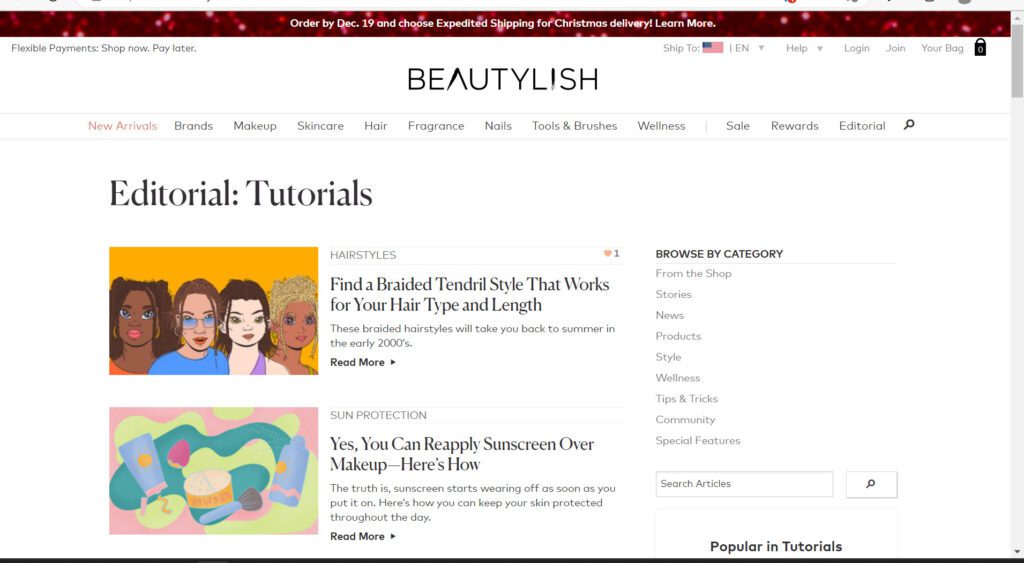

Beautylish is just one example of a site that takes its tutorials seriously. Its editorial section is quite robust and visitors can find everything from news to tips & tricks, stories and product information, making it one to visit often.

Beautylish has a comprehensive set of tutorials to educate shoppers.

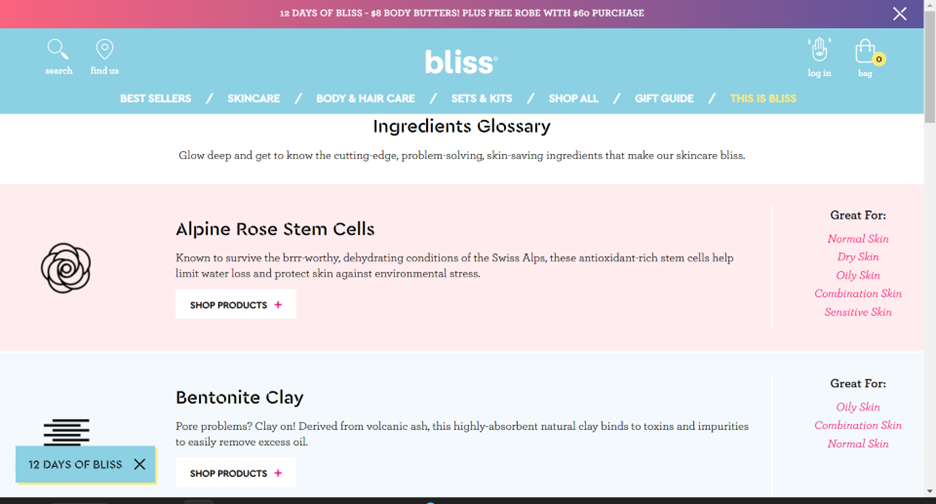

Education comes in many formats, and ingredients are an integral part of selling the beauty experience. The Bliss glossary highlights some of those ingredients and where they can be most effective.

Bliss’ ingredients glossary.

Estee Lauder had just finished up a livestream and has embraced the Netflix model and binge watching, encouraging its customers to take advantage of its livestreaming initiatives.

Livestreaming is in play for Estee Lauder.

It’s instructive to see the range of tools and capabilities that online shoppers have leveraged to guide their beauty selections.

Elf’s virtual try-on is easy to use and assists the shopper in making a better selection. Shoppers have the option to select live makeup providing access to the camera, selecting a model or uploading a photo. The experience is valuable for decision-making, though personally, I still may seek out the advice of an associate as the choices are abundant.

Elf’s virtual try-on leads to more informed choices.

Consumers embrace the personalized and customized

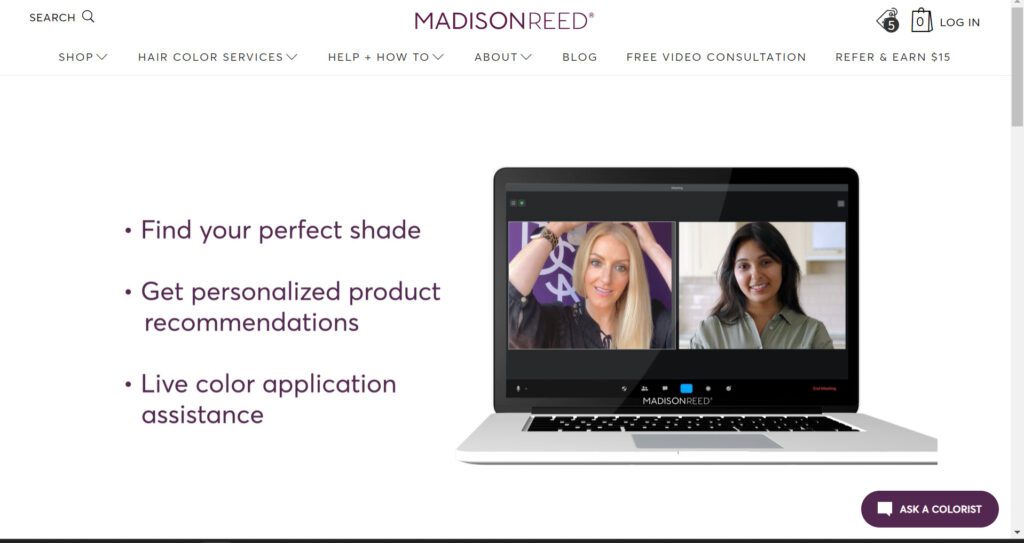

Retailers offering personalization and customization continue to see growing interest among shoppers in this category and many others. Madison Reed offers free video consultations to help its customers find the perfect shade and get personalized recommendations. The retailer also provides live color-application assistance. It would be interesting to know who uses these services and if it’s those looking to save money at the salon, but still appreciating there’s someone to help. 16% of our beauty survey respondents had chatted with a beauty expert. I can only expect that to have grown post-COVID-19.

Madison Reed uses video consultations to customize shopper experiences.

Community central to beauty experience

If ever there were a category ripe to embrace community, it certainly is beauty.

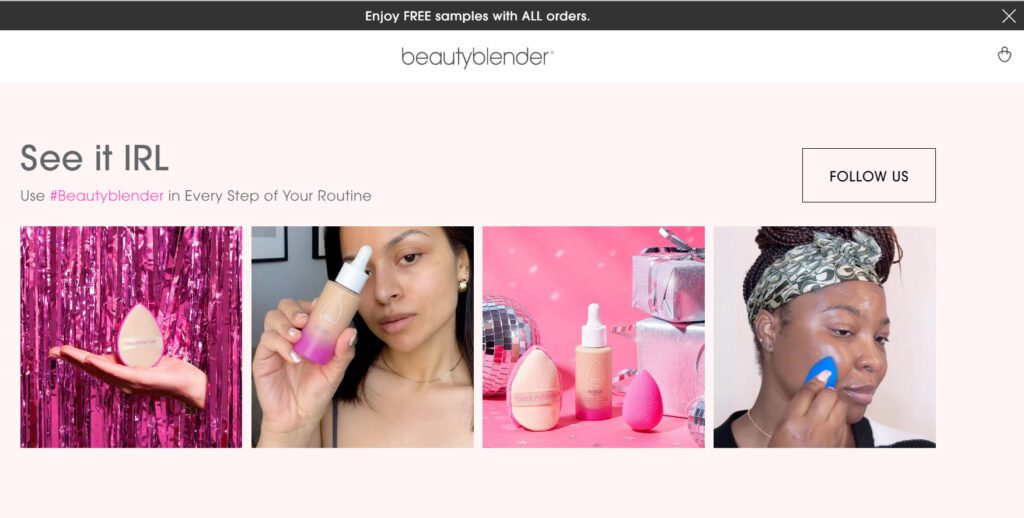

Beauty Blender lets its fans see it in real life. Social media allows community members to showcase products in action and to share their love with fellow beauty lovers.

Beauty Blender gives viewers the real-life perspective.

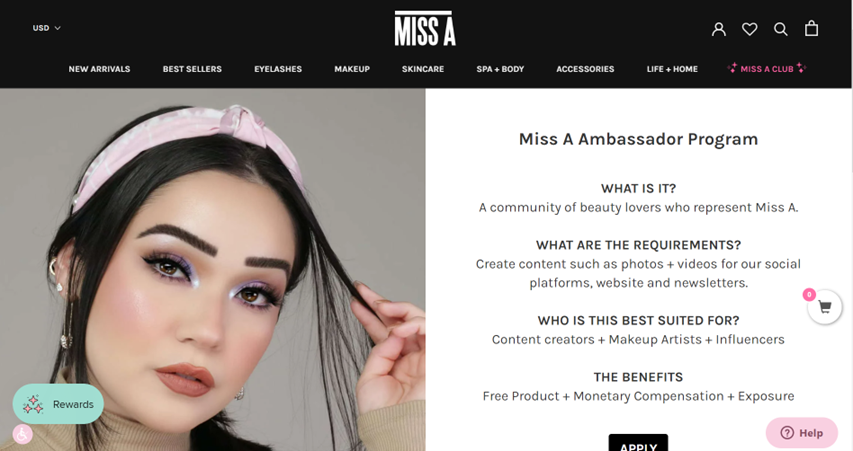

Community also means putting an ambassador program in place. For Miss A, they serve as a representative of the brand. The ambassador’s role consists of creating content including photos and videos for social platforms and more. The benefits include free products, money and personality exposure.

Miss A’s ambassador program leverages beauty lovers to tell its story.

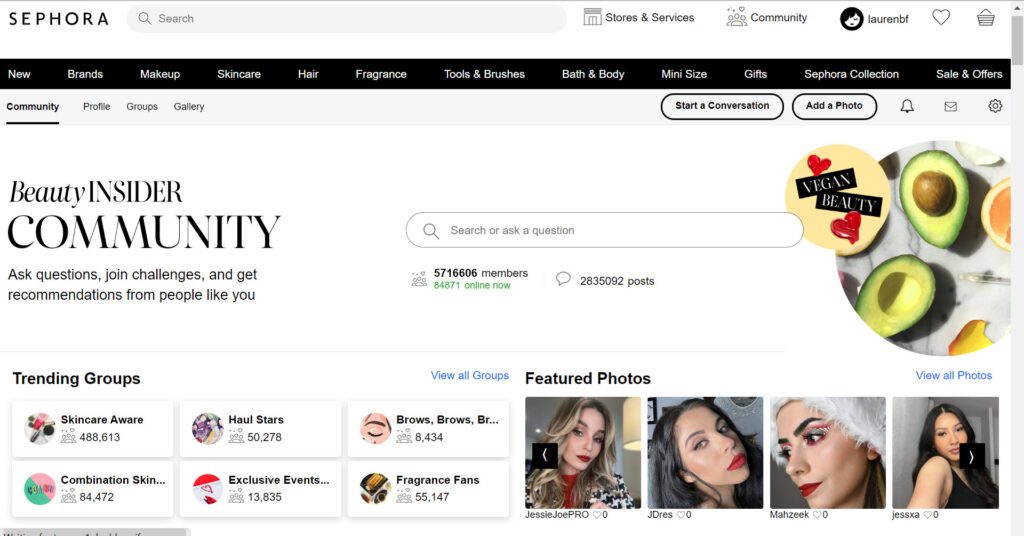

Sephora highlights the community as well. Its robust beauty community allows members to get recommendations, ask questions and join challenges. The array of topics the retailer covers is impressive.

Sephora’s Beauty Insider community fosters interaction from members.

The store takes a prominent role in beauty business

The store has an interesting role to play in beauty. Taking a look at our pre-holiday survey once again shows how important it is to check which products are available for both delivery (57%) and for pickup at the store (30%).

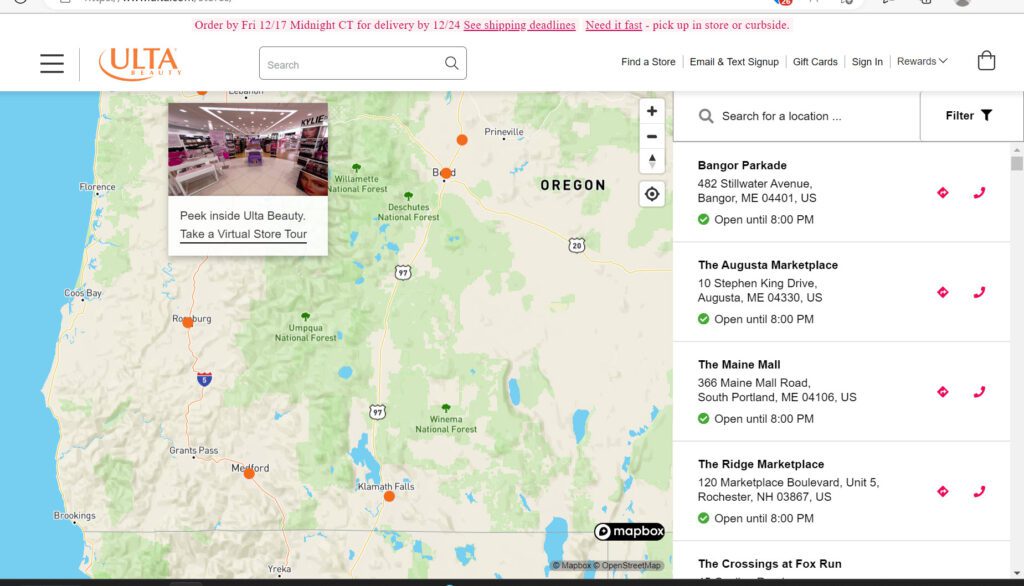

When perusing some of the beauty sites, I was impressed that I could get a view into the store experience from the Ulta site.

Ulta’s in-store preview encourages visits.

Same-day delivery sees traction

Online shoppers are increasingly interested in same-day delivery. Sally Beauty takes advantage of this trend and offers shoppers two-hour delivery over the December time frame. Our Digital Commerce 360 and Bizrate Insights beauty survey showed that 51% go to the physical store to get products fast. Sally Beauty smartly turns the tables and extends this convenience for its customers.

Sally Beauty delivers in two hours during December.

Beauty retailers have made great strides elevating the online shopping experience. The combination of shopping efficiencies that drive purchasing and online merchandising that inspires and optimizes decision-making is impressive. At the same time, building out communities makes for a complete customer package.

Sign up

Stay on top of the latest developments in the ecommerce industry. Sign up for a complimentary subscription to Digital Commerce 360 Retail News.