Without including sales from Sam’s Club, Walmart Inc. increased its share of U.S. online grocery sales in the second quarter of 2024, according to data from Brick Meets Click and Mercatus.

Brick Meets Click and Mercatus track monthly online grocery sales in the U.S.

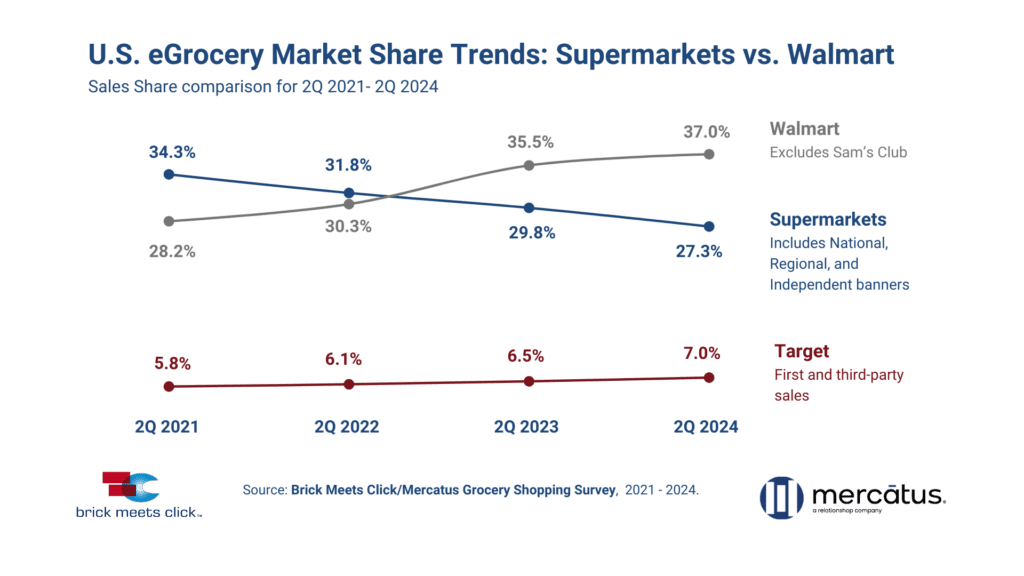

Their data highlights the roles of Walmart (excluding Sam’s Club), Target (first- and third-party sales), and supermarkets (at the national, regional and independent levels) in the U.S. online grocery space.

Walmart is No. 2 in the Top 1000, Digital Commerce 360’s ranking of North America’s online retailers by web sales. It is also No. 9 in the Global Online Marketplaces Database, Digital Commerce 360’s ranking of the top marketplaces by third-party gross merchandise value (GMV).

Meanwhile, Target is No. 5 in the Top 1000 and No. 80 in the Global Online Marketplaces Database. Digital Commerce 360 categorizes both Walmart and Target as Mass Merchants.

Walmart’s role in US online grocery sales

Data from Brick Meets Click and Mercatus shows that Walmart captured 37% of U.S. online grocery sales in Q2 2024. That share grew consistently during each second quarter after 28.2% in Q2 2021. However, the trend is reversed for supermarkets.

In the U.S., online grocery sales from supermarkets dropped to 27.3% in Q2 2024 from 34.3% in the same period in 2021.

At the same time, Target’s share of online grocery sales also increased each year, albeit more slowly, in the same period: to 7% in Q2 2024 from 5.8% in 2021.

“Walmart’s reputation for low prices helped to attract households that wanted both the convenience of shopping online and ways to save money in this market,” said David Bishop, partner at Brick Meets Click, in a statement. “The execution of its omnichannel strategy, plus the operational efficiencies aided by incredibly high order demand, has enabled Walmart to consistently deliver the type of experiences that customers expect and to lower its cost to serve online orders at the same time.”

Brick Meets Click and Mercatus split online grocery sales into three receiving methods:

- Delivery: Includes orders received from a first- or third-party provider like Instacart, Shipt or the retailer’s own employees.

- Pickup: Includes orders received by customers either inside or outside a store or at a designated location/locker.

- Ship-to-home: Includes orders that are received via common or contract carriers like FedEx, UPS and USPS, etc.

Impact of mass merchants on online grocery sales

Walmart’s focus on building its first-party delivery business has produced notable shifts in how delivery and pickup sales fall, according to the companies’ data.

Overall, Brick Meets Click and Mercatus said, Walmart and other mass merchants captured nearly half of all delivery sales within the U.S. online grocery space in Q2 2024. And despite losing a 1% share of pickup sales, mass merchants still accounted for 58% of that segment of online grocery orders in Q2.

Supermarkets, though, went from having a one-percentage-point lead over mass merchants in delivery sales in Q1 this year to trailing by 10 percentage points in Q2. Still, promotional pushes in the quarter to use Instacart helped boost supermarkets’ share of delivery sales, Brick Meets Click and Mercatus said.

For pickup, supermarkets ended Q2 2024 with about 28% of sales. Despite a shift in sales share between supermarkets and mass merchants, pickup still accounts for the most online grocery sales in the country.

“Regional grocers can safeguard their online business by targeting budget-conscious households with a convenient, seamless, and personalized digital experience,” said Mark Fairhurst, chief growth officer at Mercatus, in the statement. “This includes boosting loyalty with points, discounts, and exclusive deals; highlighting unique products and offering bundled deals for savings; and using targeted promotional campaigns … to encourage repeat online purchases.”

Do you rank in our databases?

Submit your data and we’ll see where you fit in our next ranking update.

Sign up

Stay on top of the latest developments in the online retail industry. Sign up for a complimentary subscription to Digital Commerce 360 Retail News. Follow us on LinkedIn, Twitter, Facebook and YouTube. Be the first to know when Digital Commerce 360 publishes news content.

Favorite