Today’s shopper expects flexibility from retailers. No longer tethered to home due to COVID-19, today’s hybrid shoppers want the ability to shop both online and in physical stores. Merchants are strategizing what services to expand, such as curbside and buy online, pick up in store (BOPIS), and what to cut, according to Digital Commerce 360’s 2023 Omnichannel Report.

While some retailers like Kohl’s Corp. discontinued its curbside pickup service in August 2022, and book retail chain Barnes & Noble removed designated parking spots for curbside, others are ramping up services.

Tractor Supply Co. (No. 102 in the Top 500) is investing more in BOPIS and curbside. The retailer’s conversion rate for these omnichannel services is 60% higher compared with home delivery. Men’s big and tall apparel retailer Destination XL Group Inc., (No. 458 in the Top 500) prefers to use its stores as additional fulfillment locations “as a last resort.” And home improvement merchant The Home Depot Inc. (No. 4 in the Top 500) is investing in its mobile app to give shoppers the flexibility to research products while in store as well as navigate BOPIS and curbside.

Omnichannel report findings

US ecommerce growth falls as shoppers opt for in store

Retail chains are giving Amazon a run for market share. Amazon and its third-party marketplace sellers represented 35.7% of digital spending in the U.S. in 2022. That’s down from 36.9% in 2021. While the web giant accounted for a fifth — 20.7% — of all gains in U.S. ecommerce in 2022, according to Digital Commerce 360, that’s a big drop compared with 34.4% in 2021 and 35.1% during the pandemic-fueled ecommerce boom of 2020. There’s ground to be gained by retailers able to leverage technology and strategy — like omnichannel services — to convert a shopper who wants convenience and dependability online and in store.

Digital Commerce 360 projects U.S. retail sales will grow 4.2% in 2023 to $5.08 trillion. Online retail sales will increase 5.8% to $1.08 trillion — the slowest growth for total retail since 2019 and for e-retail since the banking crisis of 2008-2009.

Ecommerce growth has slowed, but it continues to take market share from brick-and-mortar stores. U.S. ecommerce grew 7.7% in 2022. That’s less than half of 2021’s 17.8% and still lower than pre-pandemic 2019 with 12.5% growth.

BOPIS and curbside availability shifts in the Top 500

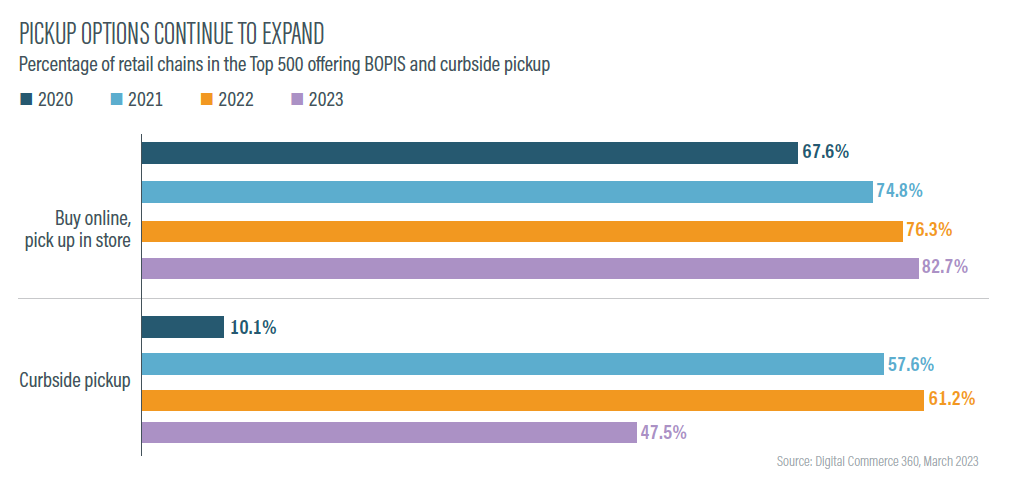

Retail chains in the Top 500 in 2023 reflect a consumer more comfortable returning to in-store shopping while leveraging online buying capabilities. BOPIS for retail chains in the Top 500 reached 82.7% penetration in 2023, up from 76.3% in 2022.

Curbside for retail chains in the Top 500 declined to 47.5% adoption in 2023, down from 61.2% in 2022. The ability to schedule an in-store appointment also dropped, to 16.5% in 2023 from 24.5% in 2022. This suggests that consumers are returning to impromptu shopping as pandemic-related fears subside and people are no longer fearful of gathering in public.

This article is based on Digital Commerce 360’s 2023 Omnichannel Report. Digital Commerce 360 Gold and Platinum Members receive a complimentary copy of this report as part of their membership. Non-members can purchase a downloadable PDF of this report for $399. View the table of contents here.

Sign up

Stay on top of the latest developments in the ecommerce industry. Sign up for a complimentary subscription to Digital Commerce 360 Retail News.

Follow us on LinkedIn, Twitter and Facebook. Be the first to know when Digital Commerce 360 publishes news content.