Key Ecommerce Statistics on Hardware & Home Improvement Category – Snapshot

HARDWARE & HOME IMPROVEMENT

ONLINE HARDWARE STORE & HOME IMPROVEMENT ECOMMERCE

|

|

Average hardware and home improvement sales grew slightly in 2023

Online Hardware & Home Improvement sales slowed in 2023. The median conversion rate dipped a bit, from 3.2% in 2022 to 3.0% in 2023. Median monthly unique visitors increased in the same period, from about 398,000 in 2022 to about 515,000 in 2023. That’s a 23% increase year over year.

Consumers who did visit Hardware & Home Improvement websites spent more, though. Median average ticket grew about 3%, from $307 to $315.

|

Online sales grew by over $5 billion

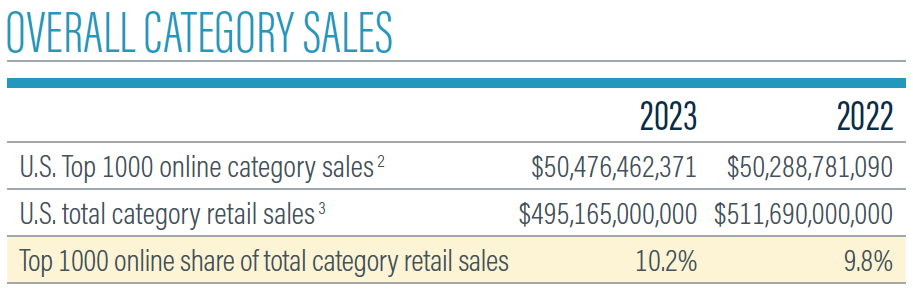

Online sales grew by about $187 million

Online sales from all 82 category retailers in the Digital Commerce 360 Top 1000 reached $50 billion in 2023. Those sales made up 10.2% of total combined in-store and online sales in the category. Penetration was up slightly from 10.8% the previous year.

Four of the top 5 retailers in the category had growth in 2023. Home Depot and Lowe’s, the top category retailers, both reported slight ecommerce gains, but third-place Ferguson reported a 9% decline for its residential direct-to-consumer business.

|

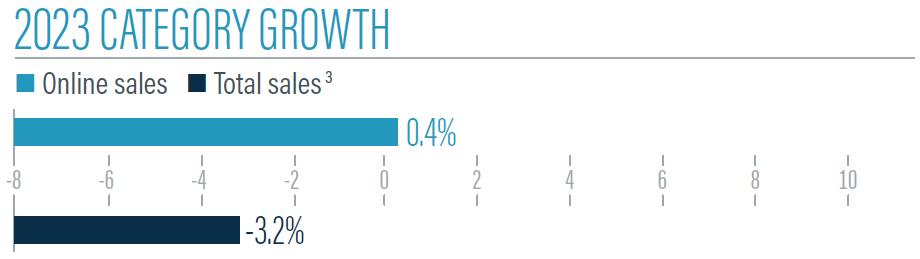

Online sales in Hardware & Home Improvement barely grew, while total sales for the category declined. Total sales declined 3.2% in 2023, while online sales grew 0.4%.

|

Home improvement sales shifted to the oldest and youngest shoppers

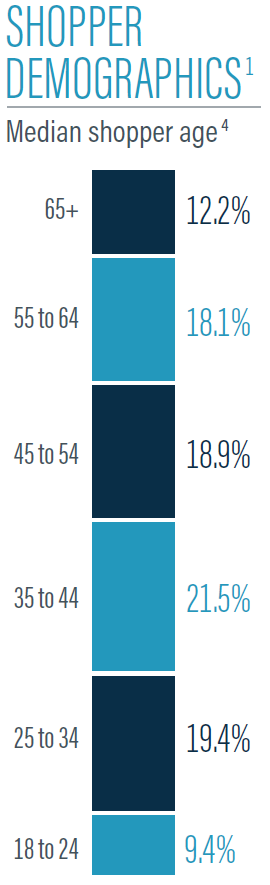

Though Hardware & Home Improvement online sales are spread across age demographics, they gained traction with some demographics in 2023.

The oldest and youngest consumers both decreased share of online Hardware & Home Improvement shoppers in 2023. Consumers 65 or older decreased their share of shoppers by 1.8%, and 18-24-year-olds decreased by 1.0%. Middle-aged consumers made up fewer Hardware & Home Improvement shoppers, with the greatest change at a 2.6% increase for shoppers 35 to 44 years old.

|

|

|

Source: Digital Commerce 360 1. Digital Commerce 360 analysis of SimilarWeb traffic data. 2. Includes only U.S. sales from the sites of U.S.-owned retailers for consistency with the U.S. Department of Commerce’s methodology. 3. Digital Commerce 360 analysis of U.S. Department of Commerce retail data. 4. Medians won’t sum to 100%

Hardware & Home Improvement Category News Feed