Key Ecommerce Statistics on Housewares & Home Furnishings Category – Snapshot

HOUSEWARES & HOME FURNISHINGS

Buying Housewares & Home Furnishings Online

|

|

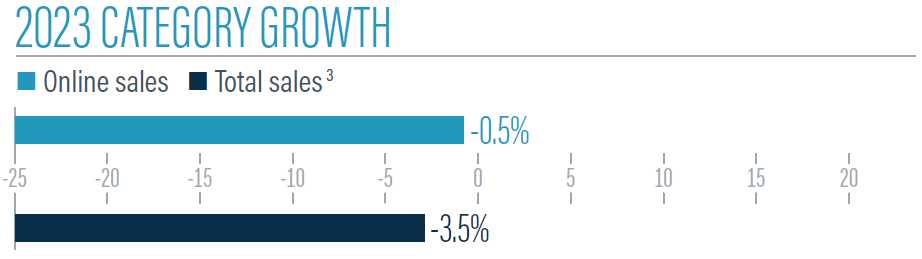

Online sales decline again for Housewares & Home Furnishings

It wasn’t just Housewares & Home Furnishings retailers in the Top 1000 that lost sales in 2023. It was the whole category in the United States.

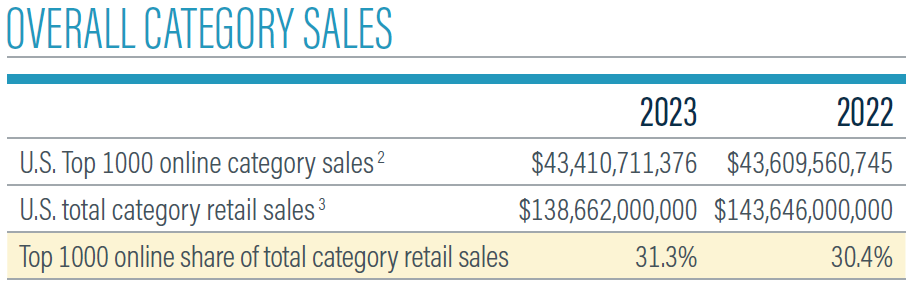

Sales Top 1000 retailers in the Housewares & Home Furnishings category fell to about $43.41 billion in 2023. That’s down from about $43.61 billion the year before. Similarly, the total retail sales for U.S. retailers in the category dropped in 2023, to about $138.66 billion from about $143.65 billion in 2022.

But if there’s a bright spot for the Top 1000 retailers in the Housewares & Home Furnishings category, it’s that they increased their share of the total retail sales in the category, to 31.3% in 2023 from 30.4% the year before.

|

Conversion rate for Housewares & Home Furnishings retailers

The online conversion rate for Housewares & Home Furnishings retailers in the Top 1000 was not a bright spot, though. It dropped to 2.2% in 2023 from 2.4% in 2022. It was also below the median conversion rate for the Top 1000 as a whole in both years.

|

Helping keep the category’s sales afloat is the rise in median average order value. In 2023, that increased to $525 from $501 the year before — likely the result of inflation.

|

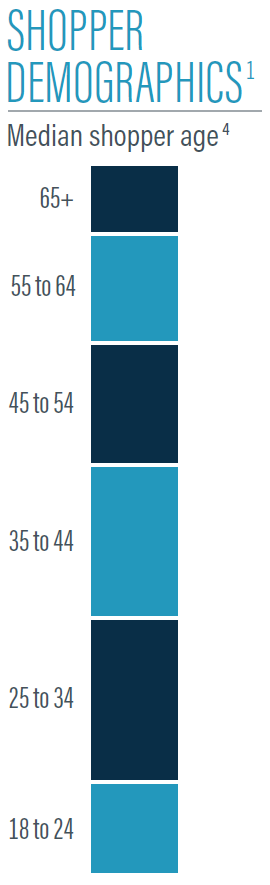

Who buys housewares and furniture online?

As is the case among many categories, the answer is largely millennials.

Those age 25-44 account for close to half of all online sales in the category. More specifically, the 25-34 age group accounted for nearly a quarter of all sales to the category’s retailers (23.0%), and those 35-44 accounted for more than a fifth (21%).

The share of sales by age group continues to decline among older cohorts. The percentage of online sales to Top 1000 Housewares & Home Furnishings retailers drops to 16.9% for those 45-54. It then decreased to 15.1% for those 55-64.

Although that share is smallest among consumers 65 and older (9.8%), it’s not far from the share for those 18-24 (12.7%). Consumers in that youngest demographic often do not have their own homes to furnish anyway.

|

|

Source: Digital Commerce 360 1. Digital Commerce 360 analysis of SimilarWeb traffic data. 2. Includes only U.S. sales from the sites of U.S.-owned retailers for consistency with the U.S. Department of Commerce’s methodology. 3. Digital Commerce 360 analysis of U.S. Department of Commerce retail data. 4. Medians won’t sum to 100%

Hardware & Home Improvement Category News Feed